![]() Trade capture

Trade capture

All valid trades/positions are included in the risk calculation.

1. Count is matching - No trade/position is missing or added

2. Economic aspect factors are captured correctly

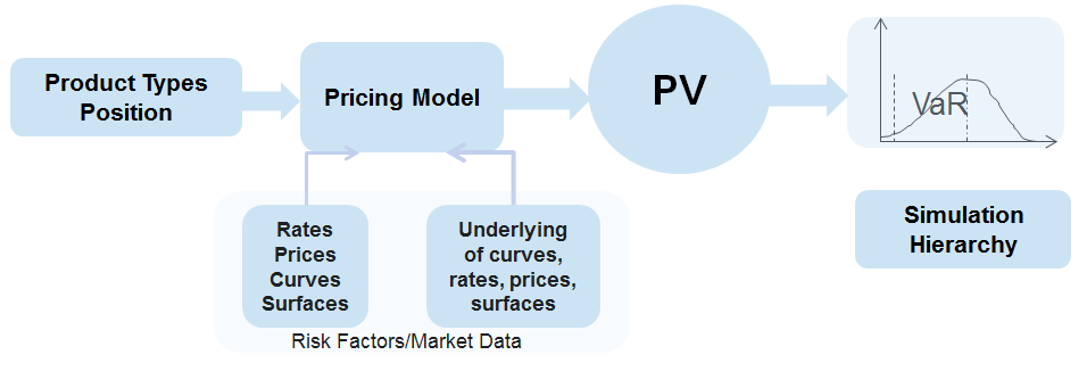

3. Reporting factors Position amount is correct![]() Market data is correct and complete

Market data is correct and complete

1. IR Curve, CDS, and underlying securities

2. Vol surface/Cube

3. Closing rate/price![]() Risk Metrics

Risk Metrics

1. Delta, Gamma

2. Vega

3. MTM/PV![]() Daily VaR measures

Daily VaR measures

1. DGV VaR

2. Stress VaR

3. Full Reval VaR![]() Stress VaR

Stress VaR![]() Back test

Back test![]() Stress test

Stress test![]() Breach investigation

Breach investigation![]() Limit Letter monitoring

Limit Letter monitoring